Growth Marketing Strategies for Financial Advisors: A Comprehensive Guide

In the current, highly competitive field of financial advisory, the adoption of growth marketing strategies has become essential for staying competitive and achieving sustainable success. As a financial advisor, it’s crucial not only to provide expert guidance, but to also employ effective marketing tactics that attract, nurture, and retain clients. Yet, a Broadridge Financial Solutions survey found that 77% of advisors have no defined marketing strategy and only 49% of advisors are confident that they will meet their practice growth goals within the next 12 months. Yikes! That’s surprising, given the advisor satisfaction rate with marketing ROI was 68% in 2022. And it should be since a well-designed financial advisor marketing plan can help you keep your competitive edge by increasing your visibility and effectively communicating your value proposition to potential clients. A bonus aspect of creating a strong marketing plan is compliance. That said, as a financial advisor, you need to seriously consider a growth marketing plan. I can help.

So, what is growth marketing? Growth marketing encompasses a wide array of techniques and approaches aimed at attracting and retaining clients, while expanding your practice. In this comprehensive guide, I’ll explore growth marketing strategies tailored specifically for financial advisors, including content marketing, email marketing, SEO, and social media. Additionally, I’ll breakdown the critical aspect of compliance and regulations within the financial industry. Finally, I’ll explain how harnessing the power of data can drive business growth by precisely targeting the right clients, building stronger relationships, and ultimately converting them into loyal buyers of your financial products or services.

Understanding Growth Marketing for Financial Advisors

Defining Growth Marketing

Growth marketing is a dynamic approach focused on driving sustainable business growth through data-driven strategies. Within growth marketing, programs such as content marketing, SEO email marketing and social marketing are used with an inbound strategy, instead of an outbound marketing strategy.

What’s the difference between inbound marketing and outbound marketing?

- Inbound marketing focuses on attracting potential customers by producing educational content that positions your brand in front of relevant, targeted consumers.

- Outbound marketing focuses on reaching out to a wide audience, initiating the conversation or by sending messages to that audience.

- Inbound marketing is education-based, while outbound marketing is awareness-based.

- Inbound marketing is “magnetic” and geared toward a target audience, while outbound marketing pushes messages to a wide audience.

- Inbound strategies rely on new leads coming to your company of their own free will, which can help build trust in consumers. Outbound marketing involves reaching out to potential leads directly through advertising, email marketing, cold calling, and other proactive methods.

The benefits of Inbound Marketing versus Outbound Marketing

- Inbound leads cost 61% less than outbound leads.

- Each dollar spent on inbound marketing generates 3x as many leads than outbound marketing.

- 93% of companies using inbound marketing increase lead generation.

- The average cost per lead drops by 80% after 5 months of consistent inbound marketing.

For financial advisors, this means merging inbound strategies with growth marketing plans through content, email, social and SEO to attract and retain clients effectively and on budget. There’s really no debate.

Difference Between Growth Marketing and Traditional Marketing

Traditional marketing often involves broad tactics, while growth marketing centers on targeted and measurable strategies. Financial advisors need to shift towards personalized, results-driven marketing. It’s worth it: Personalized emails deliver six times higher transaction rates. Target the right customers, send them the information they want, and build trust to increase your client base. It’s that simple. In this article, I’ll explain how this can be done for pennies on the dollar.

Content Marketing for Financial Advisors

Attracting and Educating Clients

When it comes to an inbound growth marketing strategy, few tactics are as effective as content marketing. It’s a tactic that not only draws potential clients to your website, it also empowers them with valuable information about financial matters. This dual-purpose approach is akin to positioning yourself as a trusted expert, while providing genuine value to your audience.

Content marketing is about creating valuable, informative content that not only attracts potential clients, but also educates them about financial topics they’re interested in. Blog posts, ebooks, and webinars are effective content formats. Each piece should align with the pain points and inquiries of your clients, positioning you as an authoritative resource in your field.

The primary purposes of content marketing for financial advisors are:

- To attract high net worth (HNW) individuals and top-qualified investors.

- To build trust and become a reliable source of information about the dynamic economic environment.

- To build relationships with independent contractors or partners, such as wealth managers or insurance brokers.

Content marketing generates three times more leads than traditional marketing, making it a highly effective approach.

Financial clients are often looking for practical advice and actionable tips. Some popular content ideas for financial advisors include:

- Explaining financial concepts in layperson’s terms.

- Creating step-by-step guides for investment and savings.

- Tips for effective budgeting and money management.

- Real-life stories of financial success and transformation.

- Inviting industry experts to share insights and advice.

- Providing updates on what’s happening in the finance industry.

- Creating white papers to demonstrate your knowledge on complex financial topics.

Content Marketing Can Produce a High ROI

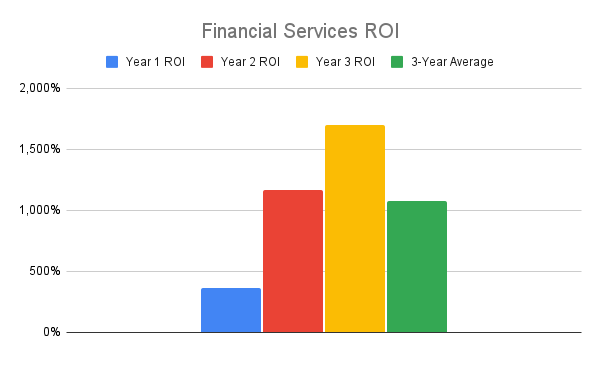

Content marketing for financial advisors consistently yields a high ROI. Wealth advisors, fund managers, and fintech companies have seen an ROI as high as more than 1,000%. The most popular content topics include financial forecasts, editorials, and guides to finance-related rules, laws, and policies (ex. estate tax planning, 1031 exchanges, and Rule 10b-5).

Compliance in Content Creation

Financial advisors must be acutely aware of compliance regulations when creating content, making it critical to ensure all content meets industry standards and adheres to financial laws.

Click image to enlarge. Image courtesy of FirstPageSage

Email Marketing Strategies

Nurturing Leads and Building Relationships

Email marketing is a cornerstone of growth marketing. In the case of financial advisors, it allows them to easily contact their target audience, nurture leads over time, and build trust and credibility. Automated email sequences can educate clients and keep them engaged. From initial contact to onboarding and ongoing communication, email sequences ensure that your clients receive personalized, relevant information at the right time. If you’re not building a subscriber list and using it as a means of distributing your content via email, you’re missing a large opportunity to grow your business cost-effectively.

The ROI for email marketing is $42 for every $1 spent.

Compliance in Email Marketing

The financial industry has strict regulations around email communication. For example, the CAN-SPAM Act governs commercial email messages and requires clear and accurate information in the subject line and a mechanism for recipients to unsubscribe. Violations of this act can result in fines of up to $43,792 per email. Therefore, it is paramount to ensure your email campaigns comply with these regulations to avoid legal issues.

SEO Strategies for Financial Advisors

Visibility and Client Acquisition

SEO is essential for making your financial advisory website visible to potential clients. Optimizing your website for relevant keywords and phrases can improve your search engine rankings and enhance your visibility. Google receives over 5.6 billion searches per day.

Local SEO for Geographic Targeting

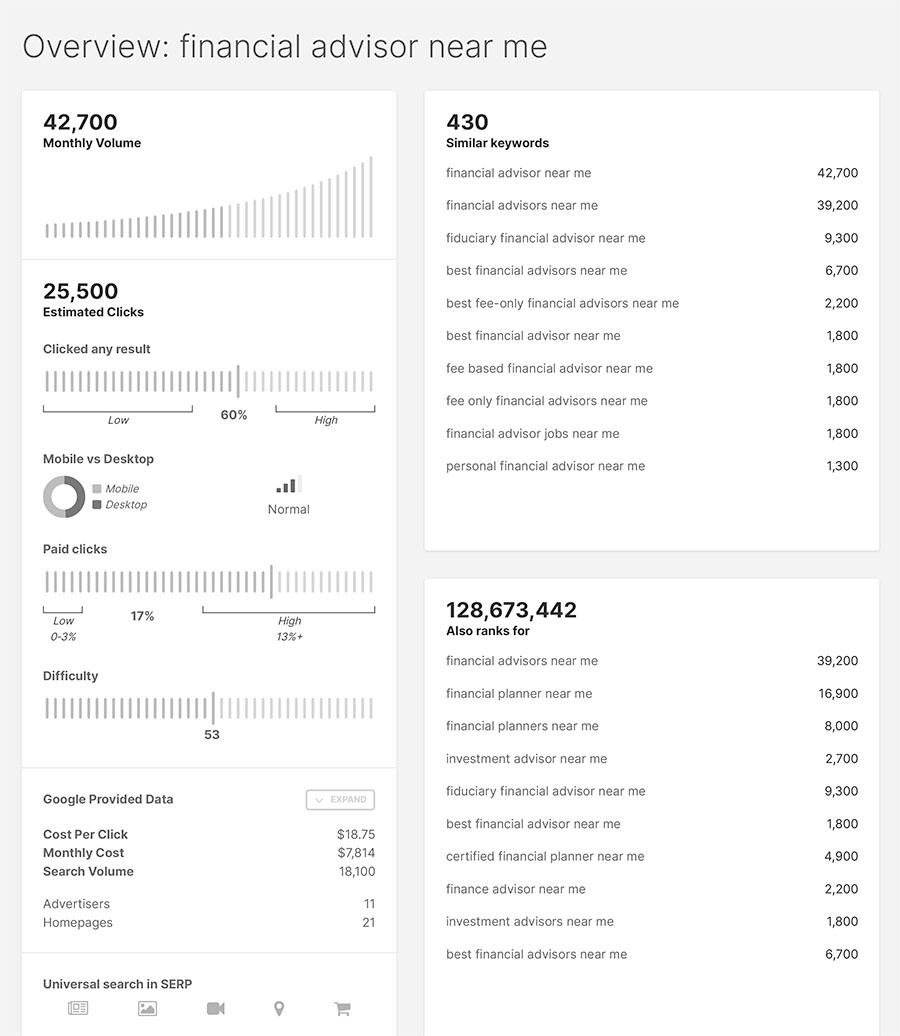

For advisors targeting specific geographic areas, local SEO is key. It helps clients find you when they search for financial services in their area. My data shows the key phrase, “financial advisor near me” is searched for 42,700 times per month. (see graphic)

Bright Local found that 72% of consumers who performed a local search visited a store within five miles. This shows that SEO, and especially local SEO, is a critical factor in being discovered by potential clients and to drive in-person visits.

Effective SEO strategies for financial advisors involve in-depth keyword research, optimizing your website’s structure and content, and building high-quality backlinks. By aligning your website with the specific queries and needs of your target audience, you increase the chances of attracting the right clients.

Leveraging Social Media for Growth

Social media has emerged as a powerful tool for financial advisors. It offers a unique platform to connect with potential clients, share valuable content, and build a strong online presence. It also allows you to communicate directly with your target audience, take surveys and glean valuable information about the information they’re looking for and the financial questions they’re asking. Additionally, by effectively leveraging social media, financial advisors can expand their reach, engage their audience, and ultimately drive business growth.

Here are some strategies and statistics that highlight the potential of social media for financial advisors.

The Benefits of Using Social Media Platforms

Social media platforms provide an accessible and interactive way to connect with potential clients, showcase expertise, and share valuable insights. It allows for an open and direct line of communcation for one-to-one conversations, making your services more personal.

Here are some key advantages of using social media for growth:

Building Credibility: Regularly sharing informative content and engaging with your audience on social media can help establish credibility and trust – two huge factors for people when choosing a financial advisor.

Increased Visibility: Social media allows financial advisors to reach a broader audience beyond their immediate network.

Real-Time Engagement: It enables real-time engagement, making it easier to address questions and concerns promptly.

Maintaining a Professional and Compliant Social Media Presence

Like almost everything in marketing for financial advisors, maintaining a professional and compliant social media presence is crucial – especially in the highly regulated financial industry. Financial advisors must strike a balance between a professional online presence and adherence to industry regulations.

In a study by Hootsuite, 28% of financial service professionals cite regulatory compliance as a significant challenge in using social media for business.

HootSuite offers an outline about how to stay compliant on social media. They suggest the following:

- Control access to social accounts. Limiting access to your accounts is a smart way to keep your content under control.

- Monitor your accounts.

- Archive everything

- Create a content library.

- Disclose sponsored content.

- Invest in regular training.

- Create social media compliance policies.

To navigate these challenges, financial advisors should:

- Familiarize themselves with industry-specific regulations regarding social media use.

- Develop a clear social media policy that outlines acceptable practices and content.

- Consider the use of compliance tools and regularly monitor and review social media activities to ensure they meet regulatory requirements.

While social media has become an integral part of growth marketing for financial advisors, it comes with its regulator challenges. However, that’s par for the course in industries such as the financial management. But it’s worth it. By harnessing the potential of social media platforms, advisors can expand their reach, engage with their audience, and build trust and credibility, ultimately, resulting in a stronger reputation and more business.

Data-Driven Growth

Data is the fuel that powers informed decisions and strategies for inbound growth marketing programs. For financial advisors, leveraging data is essential for attracting the right clients, building stronger relationships, and achieving sustainable growth. With proper set up and monitoring practices, data-driven approaches can transform your financial advisory business. And as people accostumed to studying data, it should come fairly easy.

The Power of Data in Growth Marketing

Data is at the heart of a majority of growth marketing programs, allowing you to make informed decisions and tailor your strategies effectively. It empowers you to better understand your target audience, track the performance of your marketing efforts, and refine your approach to adjust campaigns quickly for optimal results. See my article, Leveraging Data for Small Business Success, for some insight on how to do make the most of your marketing data.

Leveraging data for marketing works. In fact, companies that embrace data-driven marketing are six times more likely to be profitable year-over-year.

How data-driven strategies can benefit financial advisors:

Precise Targeting

Data allows you to identify and target the most relevant and profitable client segments. Think about how your business would grow if you could target the HNW people within a 30 mile radius of your office and consistently market to them and build trust.

Personalization

You can create highly personalized content and experiences based on client preferences and behaviors. I can set up your email and website to track and measure user engagement, allowing you to narrow their interests, so you can send them specific information based on what they’re looking for. Remember the statistic about personalized email (and content) delivering a 6x transacrion rate. It works.

Optimization

Data helps you optimize marketing campaigns in real-time for better performance. I use our data dashboards to adjust campaigns and messaging on the fly to increase effectiveness. The system I set up makes it easy.

Collecting and Analyzing Data

Obviously, to harness the power of data, you must collect and analyze relevant information systematically. This process involves gathering data from various sources, such as website analytics, email marketing platforms, social media insights and other software we use for SEO and user data.

Data-driven businesses are 23 times more likely to get new clients.

How to collect and analyze data effectively:

- Utilize data analytics tools to track website visitors, conversion rates, and user behavior.

- Leverage customer relationship management (CRM) systems to centralize client data.

- Score leads and visitors on your website to monitor and rank who’s the most active.

- Implement A/B testing to refine marketing campaigns and strategies based on data insights.

Turning Data into Action

Collecting and analyzing data is just the first step. Using the data to drive campaigns and guide decistions is the true power of data-driven marketing. You should use data insights to inform marketing strategies, messaging, content creation, and client engagement tactics. Turning data into action drives tangible results. For example, McKinsey finds companies using data to optimize their marketing and sales operations are 23 times more likely to acquire customers and 6 times more likely to retain them.

How to turn data into action:

- Tailor content marketing efforts based on data about client interests and preferences.

- Implement marketing automation to deliver personalized messages at scale. Be sure to monitor the automation and adjust according to lead interaction. (I’m sure you’ve gotten an additional message sent to you from a company or person you’ve already engaged with and rejected because they’ve neglected to adjust their automation to drop you from the sequence.)

- Continuously monitor and adapt strategies based on data-driven insights for ongoing improvement.

Make data-driven growth the cornerstone of your marketing efforts. By harnessing the power of data, you can make informed decisions, optimize strategies, and provide highly personalized experiences to increase conversions.

Compliance and Regulatory Considerations

Adherence to compliance and regulatory standards is non-negotiable. As you know, the financial industry is heavily regulated, and violating these regulations can have severe consequences. Compliance is at the heart of all growth marketing programs and remains the ultimate guide in all efforts.

Adhering to Regulatory Standards

Navigating the regulatory landscape is essential for financial advisors engaged in any type of marketing. Failure to adhere to industry-specific regulations can result in severe consequences, including fines, legal actions, and damage to your reputation, and that’s not good for anyone.

Consider this: In a report by PwC, 52% of financial services CEOs expressed concern about over-regulation, which reflects the ongoing challenge that regulatory compliance poses to financial institutions and advisors.

How to adhere to regulatory standards:

- Familiarize yourself with industry-specific regulations, including those governing marketing and client communications.

- Develop a clear compliance policy outlining acceptable marketing practices and content guidelines.

- Implement regular compliance checks and audits to ensure all marketing activities align with regulations.

Adhering to industry-specific regulations is essential to avoid legal complications and protect your reputation. Collaboration with compliance departments or consultants and a proactive approach to regulatory adherence are crucial in navigating the complex regulatory landscape of the financial industry.

Conclusion

In the ever-evolving world of finance, where competition is fierce, and client trust is paramount, embracing inbound growth marketing strategies is not just a choice, it’s a necessity. This article has taken you through some tailored inbound growth marketing tactics specifically designed for financial advisors, offering valuable insights into how you can expand your client base, build stronger relationships, and drive business growth.

As you implement these strategies, always remember that growth marketing is not a one-time effort, it’s an ongoing journey. Continuously adapt to changes in your industry and your clients’ needs. Collaborate with your compliance department or experts, stay informed about evolving regulations, and keep an eye on the data to refine your approach – if you have the time. If you don’t, consider enlisting the help of a consultant like me, who will help you devise a plan, set up campaigns, implement data dashboards, and guide you through the marketing world towards an increased book of business.

Think of it like this: I hired a financial advisor to help me navigate the world of investments and financial management. Why wouldn’t you do the same with marketing your business. As I work with my advisor, he helps me grow my net worth, as I, a marketing consultant, would help you grow your business.

Additional Resources and References

Expanding your knowledge in growth marketing for financial advisors is an ongoing journey. To help you dive deeper into these strategies and stay updated on industry trends, here are some valuable resources and references:

1. Books

“Digital Marketing for Dummies” by Ryan Deiss and Russ Henneberry: This comprehensive guide covers various aspects of digital marketing, including content marketing, SEO, and social media strategies.

“Influence: The Psychology of Persuasion” by Robert Cialdini: Understanding the principles of persuasion can be invaluable for growth marketing efforts.

2. Online Courses and Certifications

HubSpot Academy: Offers free online courses on inbound marketing, content marketing, and email marketing, among others.

Google Digital Garage: Provides a wide range of digital marketing courses, including SEO and social media marketing.

3. Industry Associations and Websites

Financial Planning Association (FPA): The FPA offers resources, webinars, and events for financial advisors looking to enhance their marketing strategies.

Investopedia: A valuable source for financial news and educational articles on various aspects of finance, including marketing.

4. Compliance and Regulatory Resources

Securities and Exchange Commission (SEC): The SEC’s website provides information on compliance regulations for financial advisors and investment professionals.

Financial Industry Regulatory Authority (FINRA): Offers resources and guidelines on compliance for the financial industry.

5. Marketing and Data Analytics Tools

Google Analytics: A powerful tool for tracking website performance and user behavior.

Mailchimp: A popular email marketing platform with features for automation and compliance.

References:

- HubSpot: 19 Eye-Opening Email Marketing Stats

- Statista: Email Marketing Statistics

- BrightLocal: Local Consumer Review Survey

- Forbes: Six Data-Driven Marketing Trends for 2021

- McKinsey: Analytics Comes of Age

- American Bankers Association: Regulatory Compliance Top Concern for Banks

- Thomson Reuters: 2021 State of Regulatory Compliance

More Financial Articles

Top Financial Mistakes to Avoid in Your 30s

Avoid These Financial MistakesEver wondered why so many people in their 30s struggle financially despite decent incomes? It's not just about income;...

The Difference Between Fiduciary and Non-Fiduciary Advisors

Fiduciary vs. Non-Fiduciary Advisors: What You Need to KnowChoosing the right financial advisor is crucial for securing your financial future. One...

Retirement Planning: When to Start and How to Save

Retirement Planning: When to Start and How to SaveStarting to plan for retirement can seem daunting, but it's one of the most important financial...

Top Benefits of Whole Life Insurance for Wealth Planning

What Are the Benefits of Whole Life Insurance in Wealth Planning?Are you considering whole life insurance as part of your wealth planning strategy?...

How a GRC System Helps Your Internal and External Auditors

As businesses become more global and complex, and regulatory requirements and scrutiny increases, the demand for a flexible internal control system...

How to Automate Your Compliance Process with Salesforce

As demand for governance, risk and compliance (GRC) automation rises, many organizations are realizing there are relatively few automation options...

Treasury’s Blind Spot: Understanding and Managing Covenant Default Risk

We find that Treasuries justify weak practices because they assume that the default risk is small and they trivialize the consequences, thinking...

12 Steps to Take to Avoid Debt Default

A primary treasury objective is to maintain and maximize access to the capital and debt markets at the lowest cost – which means consents before the...

How Compliance Central Helps Your CFO and CAO

Let’s face it, CFOs, CAOs and financial teams, in general, have a lot of responsibilities for the financial functions and health of an organization....

The Advantages of Compliance Central over a Manual Process

Creating consistent GRC data standards and communicating them effectively is challenging for many organizations. Often, source data from multiple...

Top 5 Steps to Avoid a Default

Did you know companies today are defaulting at more than twice the rate of 2015? In fact, there were more corporate defaults in the first nine...

How Compliance Central Increases Visibility

As organizations look to improve the way they manage risk, internal controls and compliance processes, Compliance Central is offering a software...

Why CFOs and Treasurers Should Consider Debt Compliance Software

Did you know many CFOs sign the quarterly certificate without a process that confirms and documents the compliance with all of the agreements’...