We find that Treasuries justify weak practices because they assume that the default risk is small and they trivialize the consequences, thinking only that their friendly lenders would be forgiving of any technical default. These assumptions could cost Treasurers and CFOs their jobs. S&P’s annual default study shows that actual hard default risk is 2 to 5x higher than speculative grade companies estimate in the Association for Financial Professionals (AFP) Survey.

With an inadequate compliance process, a technical default is likely to be long outstanding, rather than something that just happened. As we will show, a default involves much more than the lenders and is never anything that can be casually dismissed. Will your CEO and Board be forgiving of a technical default? Or will they perceive it, fairly or not, as a costly Treasury mistake due to incompetence?

“It was the worse month of my life,” said a client Treasurer of a technical default, “Every day I thought I would be fired.”

The Debt Facts of Life

- Companies have a legal obligation to manage their operations within the constraints imposed by all of their debt agreements. Lenders expect the Borrowers to understand and comply with every lender protection in the debt agreements, no matter how insignificant.

- U.S. GAAP requires any debt with a covenant violation to be classified as short term because the violation gives the lenders the right to call the debt.

- Sarbanes-Oxley requires public companies to have adequate internal controls to justify the CFO and CEO certifications that the financial statements are in accordance with GAAP and are not false or misleading.

- The PCAOB has told the auditors they need to test more, rather than just accept, management’s assertions (e.g., we are in compliance with our debt). 5. Litigious shareholders will sue about misleading financial statements that have restated the LT debt as ST debt due to long outstanding covenant violations, especially if there is a material SOX deficiency citation.

Default Risk is Not Small

Defaults can be one-time events or be undiscovered for many quarters:

- Hard defaults – missed payments, distressed debt exchanges, and bankruptcy filings (this is S&P’s definition of default in the statistics below) are one-offs.

- Technical defaults – any other kind of missed debt obligation, such as broken ratios or non-financial covenants, the latter likely to have occurred over several quarters.

- The 5-year risks of hard and technical defaults are much higher than many speculative grade companies believe, who apparently think that default can’t happen to them.

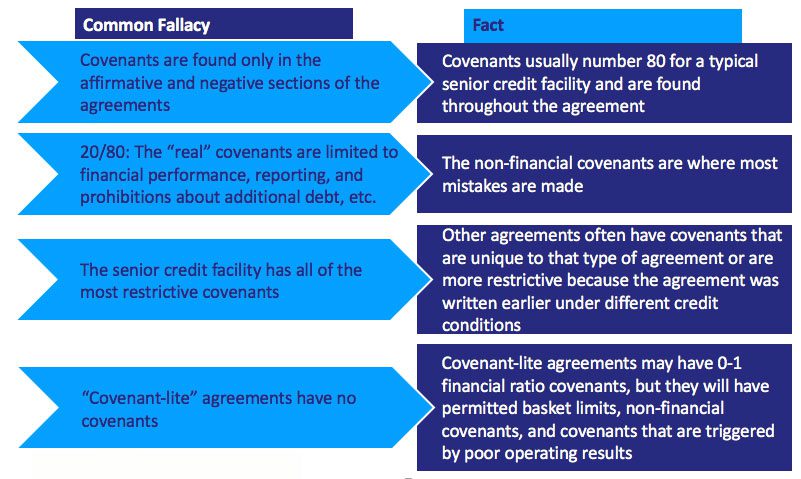

Common Covenant Fallacies

Defaulting Consequences

Few CFOs and Treasurers will survive if any of these consequences happen:

A. When known, a default must be reported quickly to the lenders per the terms of the agreement, as not reporting would be fraudulent — including reporting to other lenders due to cross-default clauses

B. Lenders will want to know the specifics of the default, when it started, and what steps the company has taken or proposes to take to remedy the default

C. The longer the default period, the more likely the 2% penalty interest is due on the outstanding debt and there’s more justification for higher waiver fees

D. The auditors will also need to be informed, and both the lenders and the auditors will insist on an intensive review for any other covenant violations

E. Auditors will also want to test when the default started because a default occurring over several quarters will cause the financials to be restated

F. ASC 470-10-45-11 requires the defaulted debt(s) to be classified as short-term for any covenant violation, no matter how insignificant

G. If a public company, such a 10-Q/A restatement would incur a material SOX deficiency citation and possibly trigger an SEC investigation for a 1934 Exchange Act violation

H. If there is public disclosure, the stock price will be hit, which will be much more costly than any penalty interest and waiver fees

I. Possible shareholder lawsuits for misleading financial statements

J. Business disruption can occur with vendors, customers, and employees

K. What the lenders will accept in satisfaction in terms of penalty interest, waiver fees, increased pricing, and new, more onerous covenants is a complex calculation of factors that are beyond the company’s control:

- The lenders’ revised evaluation of the company’s management and credit risk against existing pricing and current credit market conditions.

- And, of course, the company may be unable to borrow until the default is remedied.