Avoid These Financial Mistakes

Ever wondered why so many people in their 30s struggle financially despite decent incomes? It’s not just about income; it’s about making smart decisions. Your 30s are a pivotal time to shift from carefree spending to responsible money management. In this decade, you’re likely juggling career advancements, thinking of home ownership, or maybe even starting a family. But with these milestones come financial pitfalls that can set you back.

We’ll guide you through the top financial mistakes to avoid and how to navigate this crucial decade with financial wisdom. From failing to plan for retirement to splurging unnecessarily, understanding these common traps can help you stay ahead. So, if you’re ready to secure your financial future, read on to learn what to avoid and how to make the most of your money.

Neglecting Retirement Planning

As you stride through your 30s, it might feel like retirement is a distant memory in someone else’s future. But here’s the harsh reality: those golden years will sneak up on you faster than you think. Starting early with retirement savings can set you up for a more comfortable and secure future. Ignoring it now can lead to scrambling later. The key is to leverage the magic of compounding interest, which grows your money exponentially over time. Let’s dive into how you avoid this common financial mistake and optimize your retirement planning.

Stay Informed: Sign Up for Our Blog

Utilizing Employer-Sponsored Retirement Plans

Your employer-sponsored 401(k) can be a powerful tool for retirement savings. One of the best ways to maximize your retirement fund is by maximizing your contributions, especially when your employer offers a company match.

- Maximize Company Matches: If your company offers a match, contributing enough to get the full match is a no-brainer. It’s essentially free money added to your retirement account. For instance, if your employer matches 100% of your contributions up to 5% of your salary, ensure you’re contributing at least that 5%.

- Automate Contributions: Set up automatic contributions from your paycheck. This way, you won’t have to think about it each month, and your savings will consistently grow.

- Increase Contributions Over Time: Gradually increase your contributions as your income rises. Even a 1% increase each year can make a significant difference over time.

By taking full advantage of your employer-sponsored plans, you’re setting a solid foundation for your retirement.

Exploring IRA Options

Apart from your employer-sponsored 401(k), Individual Retirement Accounts (IRAs) offer another great avenue for retirement savings. Let’s break down the differences between Traditional and Roth IRAs and some strategies for making the most of them.

- Traditional IRA: Contributions to a Traditional IRA may be tax-deductible, reducing your taxable income for the year. However, withdrawals during retirement are taxed as regular income. This is a good option if you expect to be in a lower tax bracket in retirement than you are now.

- Roth IRA: Contributions to a Roth IRA are made with after-tax dollars, which means you don’t get a tax break upfront. The benefit comes during retirement when withdrawals are tax-free. This is ideal if you expect to be in a higher tax bracket in retirement.

Contribution Strategies:

- Max Out Contributions: The limit for both Traditional and Roth IRAs is $6,000 per year if you’re under 50. Contributing the maximum amount each year can significantly boost your retirement savings.

- Spreading Contributions: Make contributions throughout the year rather than a lump sum at the end. This approach can help you manage your cash flow better and take advantage of dollar-cost averaging.

- Mix and Match: If you’re eligible, consider contributing to both a 401(k) and an IRA. This diversification can provide more flexibility and tax advantages.

By exploring and utilizing these IRA options, you can avoid this common financial mistake and take steps to further fortify your retirement savings strategy and ensure a comfortable future.

Retirement planning in your 30s isn’t just about saving money—it’s about building a stable and secure future. Utilize these strategies to make the most of your employer-sponsored plans and IRAs, so you won’t face financial stress when that long-awaited time finally arrives.

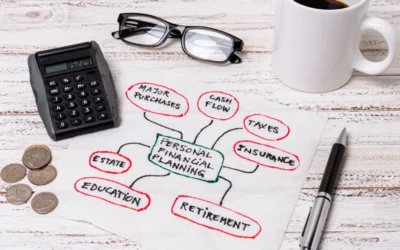

Failing to Diversify Investments

It’s crucial to ensure your money works for you, especially as you enter your 30s. One of the key financial mistakes people make at this age is failing to diversify their investments. Putting all your eggs in one basket can expose you to significant risks. Let’s explore why diversification is essential and how you can achieve it through smart asset allocation strategies.

Asset Allocation Strategies: Provide guidance on how to balance stocks, bonds, and cash for both short-term and long-term goals

When it comes to balancing your investments, asset allocation is the way to go. Think of it as a recipe: too much of one ingredient can spoil the dish. The same goes for your investments. Here’s how you can balance stocks, bonds, and cash to meet both your short-term and long-term goals.

1. Understand Your Risk Tolerance

Your first step should be to understand how much risk you’re willing to take. Are you comfortable with the ups and downs of the stock market, or do you prefer the steady, predictable returns of bonds? This will help you decide how to divide your investments between stocks, bonds, and cash.

2. Short-Term vs. Long-Term Goals

- Short-Term Goals: For goals less than three years away, such as buying a new car or saving for a big vacation, focus on lower-risk investments. A mix of bonds and cash can provide stability and quick access to funds.

- Long-Term Goals: For goals like retirement, which may be 20-30 years away, consider a higher proportion of stocks. Stocks generally offer higher returns over the long term, despite their short-term volatility.

3. The 60/40 Rule

A common approach for long-term investment is the 60/40 rule—investing 60% in stocks and 40% in bonds. This offers a balanced mix that can grow your wealth while also providing some stability through bond investments.

4. Diversify Within Asset Classes

Diversification isn’t just about spreading your money across stocks, bonds, and cash; you should also diversify within each category.

- Stocks: Spread your investments across various sectors such as technology, healthcare, and finance. Consider international stocks to increase your diversification.

- Bonds: Include a mix of government, municipal, and corporate bonds to reduce risk.

- Cash: Keep some money in high-yield savings accounts or money market funds for immediate needs and emergencies.

5. Review and Rebalance

Your asset allocation strategy isn’t a set-it-and-forget-it plan. Regularly review your portfolio to ensure it still aligns with your goals and risk tolerance. Rebalance your investments annually to maintain your desired allocation.

6. Use Tools and Resources

Take advantage of online resources and tools. Websites like Investopedia offer extensive guides on how to invest wisely. You can also use robo-advisors to automate your investments based on your risk profile.

By following these strategies, you can effectively diversify your investments and protect yourself from market volatility, ensuring your financial future is as secure as possible.

Accumulating Excessive Debt

Transitioning into your 30s is a significant milestone, often marked by better career prospects and increased earning potential. However, this period also brings a common financial challenge: the temptation to accumulate excessive debt. Whether it’s for a home, car, or credit card purchases, managing debt requires careful planning and smart strategies to avoid sinking into a financial quagmire.

Understanding Credit Scores

Your credit score is like your financial report card. It plays a crucial role in determining your ability to secure loans, credit cards, and even renting an apartment. Credit card usage heavily impacts this score. Here’s how:

- Payment History: Paying your balances in full and on time significantly boosts your credit score.

- Credit Utilization: Aim to use less than 30% of your available credit to maintain a healthy score.

- Length of Credit History: The longer your credit history, the better. Keep older accounts open and active, even if you don’t use them frequently.

Think of your credit score as the key to your financial future. Keeping balances low and paying on time can open doors to the best interest rates and most favorable loan terms. In contrast, missed payments and high balances can lock you into a cycle of high-interest debt that’s hard to escape.

Debt Consolidation Options

Managing multiple debts can feel like juggling flaming torches—one wrong move, and things can go up in flames. This is where debt consolidation can be a lifesaver. It simplifies your financial situation by combining multiple debts into a single payment.

One effective method for debt consolidation is through personal loans. Here’s why they can be beneficial:

- Lower Interest Rates: Personal loans often have lower interest rates compared to credit cards. This means you pay less in interest over time.

- Single Payment: Instead of keeping track of multiple debts, you make just one monthly payment, reducing the chance of missed payments.

- Fixed Repayment Term: Unlike credit card debt, which can stretch indefinitely, personal loans have a fixed repayment schedule, giving you a clear path out of debt.

Think of debt consolidation as hitting the reset button on your finances. By simplifying and reducing your debts, you can regain control over your financial life and work toward becoming debt-free.

Lifestyle Inflation and High-Interest Debt

Our earnings often increase in our 30s, and with that can come lifestyle inflation—the tendency to spend more as you earn more. While it’s natural to want to enjoy the fruits of your labor, it’s important to avoid high-interest debt traps. Here’s why:

- High-Interest Debt: Credit cards and some personal loans can have high interest rates, making it hard to pay off balances.

- Long-Term Financial Health: Accumulating high-interest debt can severely impact your ability to save for future priorities like retirement or buying a home.

- Consider this: a single high-interest credit card can cost you hundreds or even thousands in additional payments over time. By managing your expenditures and avoiding lifestyle inflation, you can save yourself a lot of financial pain.

Balancing your financial life in your 30s involves making smart decisions about debt. Understanding the impact of credit scores, exploring debt consolidation options, and being mindful of lifestyle inflation can help you avoid the pitfalls of excessive debt and set the stage for a secure financial future.

Becoming House Poor

Buying a home is an exciting milestone, especially in your 30s. However, rushing into homeownership without fully understanding the financial implications can lead you to become “house poor.” This means that you spend so much on your home that there isn’t enough left for other necessities or savings. To avoid this common pitfall, let’s explore the hidden costs of homeownership.

Calculating Total Homeownership Costs

When budgeting for a new home, it’s easy to focus solely on the mortgage payment. But there are several hidden costs that you must consider to avoid becoming house poor.

Property Taxes

Property taxes vary widely based on location but are an inevitable part of owning a home. These taxes are determined by your local government and can increase over time. Ignoring property taxes can make your monthly expenses skyrocket unexpectedly.

Home Insurance

Homeowners insurance is another critical cost that protects your investment from damage and liability. Depending on the policy, this could include coverage for natural disasters, theft, and accidents on your property. Be sure to shop around and find a policy that offers the right balance of coverage and affordability.

Maintenance and Repairs

Homes require regular upkeep, and these costs can add up quickly. From lawn care to fixing a leaky roof, maintenance is an ongoing expense. It’s recommended to set aside 1-3% of your home’s purchase price annually for maintenance and repairs.

Private Mortgage Insurance (PMI)

If you put down less than 20% on your home, lenders will typically require you to pay PMI. This insurance protects the lender in case you default on your loan but doesn’t benefit you directly. PMI can add hundreds of dollars to your annual expenses and should be considered when calculating your budget.

Utilities and HOA Fees

Monthly utilities such as water, electricity, and heating can be substantial, especially in larger homes. Additionally, many neighborhoods have Homeowners Association (HOA) fees that cover communal amenities and neighborhood maintenance, adding another layer to your monthly expenses.

Here’s a quick list of these hidden costs to keep in mind:

- Property Taxes

- Home Insurance

- Maintenance and Repairs

- Private Mortgage Insurance (PMI)

- Utilities and HOA Fees

By thoroughly calculating all these expenses, you can avoid the financial strain of being house poor and enjoy your new home without sacrificing your lifestyle or future savings.

Overlooking Insurance Needs

Navigating through your 30s can feel like walking a financial tightrope. As you juggle career growth, family priorities, and personal dreams, it’s crucial not to overlook insurance needs. Neglecting this essential safety net can create significant financial pitfalls. Here’s how to ensure you’re adequately covered.

Evaluating Insurance Policies

Assessing your insurance needs can be challenging but necessary. It’s crucial to evaluate your coverage and determine if it adequately protects your assets and future financial stability.

Here are some practical steps to evaluate various insurance policies:

Health Insurance

Health crises can hit anyone, anytime. Health insurance is paramount:

- Employer Plans: If available, take advantage of employer-provided health insurance. Employers often share the cost and offer robust coverage options.

- Marketplace Plans: If employer insurance isn’t an option, explore the Health Insurance Marketplace for plans tailored to your needs and budget.

- Health Savings Account (HSA): When paired with a high-deductible health plan, HSAs offer tax advantages and can help cover unexpected medical expenses.

For more on selecting the right health insurance, Healthcare.gov offers detailed guidance.

Life Insurance

Life insurance supports your family financially if you pass away. Here’s what to keep in mind:

- Term Life Insurance: Ideal for most people in their 30s, it’s affordable and covers you for a set number of years.

- Whole Life Insurance: Offers lifetime coverage and a cash value component, but it’s more expensive.

Calculate how much coverage you need based on your family’s lifestyle and future goals. For a deeper understanding, check out this life insurance guide.

Disability Insurance

Your ability to earn income is your most significant asset. Protect it with disability insurance:

- Short-Term Disability: Provides income for a few months if you’re temporarily unable to work.

- Long-Term Disability: Kicks in after short-term benefits end, covering a portion of your income for years.

Evaluate if your employer offers these policies or if you need to purchase them independently.

Property Insurance

Whether you rent or own, protecting your home is crucial:

- Homeowners Insurance: Covers your house and belongings from damage or theft. Ensure your policy includes liability coverage.

- Renters Insurance: Offers coverage for your personal belongings and potential liability if you rent.

- Umbrella Policy: Provides extra liability coverage beyond your home and auto policies, safeguarding your assets.

For more specifics on what homeowners insurance covers, check out this guide.

Taking the time to evaluate your insurance needs can save you from financial disaster. By securing health, life, disability, and property insurance, you can approach your 30s with confidence, knowing you’re protected against life’s uncertainties.

Avoiding Financial Conversations

Talking about money can be uncomfortable, but avoiding it altogether can lead to serious problems down the line. Financial disagreements are one of the top reasons couples argue and even separate. Discussing your finances can ensure you are on the same page, help you set goals together, and prevent surprises that might strain your relationship.

Setting Joint Financial Goals

Setting realistic and mutually agreed-upon financial goals can strengthen your relationship. Here are some strategies to make those conversations easier and more effective:

Schedule Regular Money Meetings

Set up a monthly meeting to discuss your finances. Consistency helps you stay on track and prevents money topics from piling up.

Be Transparent

Share your income, debts, and financial obligations. Transparency builds trust and makes it easier to plan together.

Prioritize Together

Identify what’s most important for both of you. Is it buying a home, saving for travel, or building a retirement fund?

Create a Budget

Develop a budget that aligns with your shared priorities. Tools like Mint can help track your expenses and savings goals.

Plan for Emergencies

Have an emergency fund in place to cover at least three to six months’ worth of expenses. This will give both of you peace of mind in case of unexpected events.

Celebrate Milestones

Reward yourselves when you hit your financial targets. Whether it’s a small treat or a bigger celebration, acknowledging progress keeps you motivated.

By following these steps and maintaining open lines of communication, you can avoid the pitfalls that come with financial misunderstandings. Planning together not only secures your financial future but also strengthens your partnership.

Conclusion: Navigating Your 30s with Financial Wisdom

Your 30s are a transformative decade, marked by significant milestones and growing responsibilities. Avoiding common financial mistakes during this period is crucial for building a secure future. By planning for retirement early, diversifying your investments, managing debt wisely, avoiding becoming house poor, ensuring adequate insurance coverage, and maintaining open financial conversations, you can set a solid foundation for long-term financial stability. Remember, it’s not just about how much you earn, but how smartly you manage and invest your money. Embrace these strategies, and you’ll be well on your way to a financially sound and prosperous future.

More Financial Articles

The Difference Between Fiduciary and Non-Fiduciary Advisors

Fiduciary vs. Non-Fiduciary Advisors: What You Need to KnowChoosing the right financial advisor is crucial for securing your financial future. One...

Retirement Planning: When to Start and How to Save

Retirement Planning: When to Start and How to SaveStarting to plan for retirement can seem daunting, but it's one of the most important financial...

Top Benefits of Whole Life Insurance for Wealth Planning

What Are the Benefits of Whole Life Insurance in Wealth Planning?Are you considering whole life insurance as part of your wealth planning strategy?...

Growth Marketing Strategies for Financial Advisors

Growth Marketing Strategies for Financial Advisors: A Comprehensive Guide In the current, highly competitive field of financial advisory, the...

How a GRC System Helps Your Internal and External Auditors

As businesses become more global and complex, and regulatory requirements and scrutiny increases, the demand for a flexible internal control system...

How to Automate Your Compliance Process with Salesforce

As demand for governance, risk and compliance (GRC) automation rises, many organizations are realizing there are relatively few automation options...

Treasury’s Blind Spot: Understanding and Managing Covenant Default Risk

We find that Treasuries justify weak practices because they assume that the default risk is small and they trivialize the consequences, thinking...

12 Steps to Take to Avoid Debt Default

A primary treasury objective is to maintain and maximize access to the capital and debt markets at the lowest cost – which means consents before the...

How Compliance Central Helps Your CFO and CAO

Let’s face it, CFOs, CAOs and financial teams, in general, have a lot of responsibilities for the financial functions and health of an organization....

The Advantages of Compliance Central over a Manual Process

Creating consistent GRC data standards and communicating them effectively is challenging for many organizations. Often, source data from multiple...

Top 5 Steps to Avoid a Default

Did you know companies today are defaulting at more than twice the rate of 2015? In fact, there were more corporate defaults in the first nine...

How Compliance Central Increases Visibility

As organizations look to improve the way they manage risk, internal controls and compliance processes, Compliance Central is offering a software...

Why CFOs and Treasurers Should Consider Debt Compliance Software

Did you know many CFOs sign the quarterly certificate without a process that confirms and documents the compliance with all of the agreements’...